“It's not how much money you make that matters, it's how much you keep” —Robert Kiyosaki

An integral facet of being an adult is managing finances. Goals and budgets may be helpful, but how you handle money is what determines financial independence.

The more money I earned since I started working, the more I was tempted to spend it. Thankfully, my parents were good role models. As frugal spenders, they consider the intrinsic value of things before buying them. They do not overindulge in luxuries nor shop impulsively. They did not spoil me with an excessive allowance, which made me appreciate the value of money at an early age. Because of them, I became resourceful and creatively thought of ways to earn. Through them, I learned to reinvest what I earn, making sure that my extra funds are passively earning profit when not being used.

Over the years, I learned about wise ways to manage finances, and I want to share them with you in this article.

Who Should You Bank With?

Ideally, you should have an account with one of the leading banks in the country because they're widely used to transact.

Placing your cash in different banks will also keep you from being paralyzed when a bank's system is hacked or goes offline. In a previous article, I talked about digital banks. I recommend placing an account in one, too.

RELATED: I’m in My 20s and I Want to Live off Passive Income by 40 (This Is How I Plan to Do It)

Having a relationship with different banks also gives you broader access to credit and investment products. “Spend P2,000 on your first purchase and get a free watch!” or “Earn an 8% yearly return with this special-offer mutual fund for a minimum placement of P10,000!”

Start by asking friends and family to refer you to banks they’ve had good experiences with and build your financial network from there.

How Do You Maximize Digital Wallets?

Digital wallets are software programs that allow you to make and track transactions entirely online. Let me walk you through three types.

Large traditional banks now have online counterparts in the form of a mobile app. In it, you can easily manage your account and transfer funds.

Fully-digital wallets such as GCash and PayMaya have more capabilities than traditional online banking software, such as integration to a marketplace, donations and a simpler fund-transfer process. They can be funded through bank transfers, credit cards or by cashing in at convenience stores.

Online marketplaces like Shopee and Grab also have their own version of e-wallets, in which customers can pre-pay for shopping credits and receive credit for refunds. Customers are often incentivized to do this in exchange for free delivery or discounts.

I prefer digital wallets over cash any time. I don't need to fumble for my wallet, queue up for the ATM nor manually record transactions.

Just be careful to practice good data hygiene by frequently changing your password, using a PIN and face ID to log in and not using public WiFi when making transactions as much as possible.

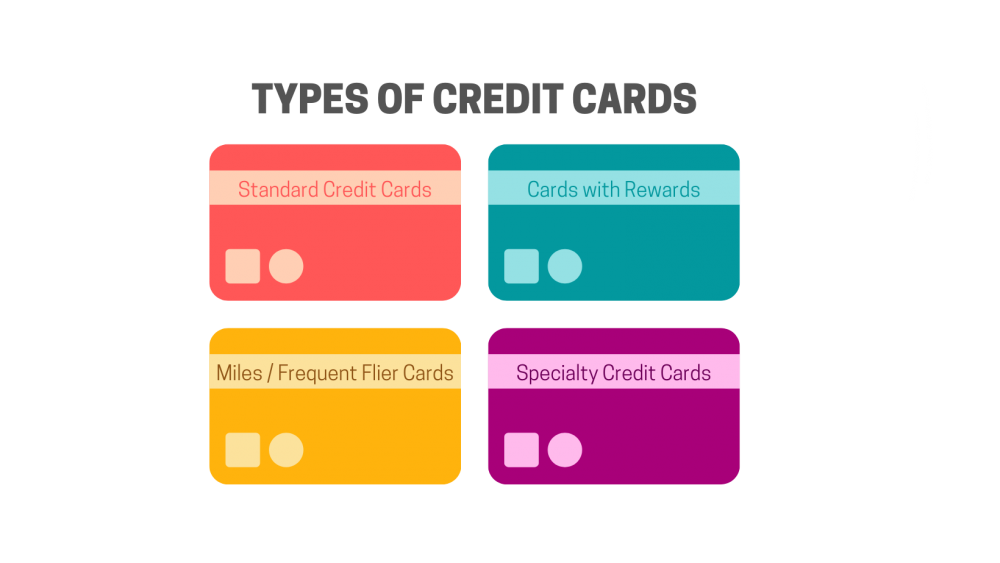

How Do You Use Credit Cards Wisely?

Credit cards essentially allow you to borrow money in the short-term, often charging between 2.5% to 4% per month if you don’t pay the balance immediately. Before, I wasn’t a fan of credit cards and just paid with cash and debit because I thought it didn’t make sense to borrow money if I could pay for everything immediately. I thought the annual fees were ridiculous, too. But I eventually realized that the rewards far outweigh the risks if you, quite literally, play your cards right.

I agree when banks say there is a credit card for (pretty much) everyone. As a frequent traveler, I was happy to find out that I get to travel for free by paying with miles-earning cards, which also come with complimentary lounge passes, priority check-ins and free travel insurance. Other types come with rebates, some with higher credit limits. Most offer discounted hotel and dining experiences.

Apply for one that best fits your lifestyle then use it every chance you get by paying with it instead of cash or debit cards. For instance, when you’re dining out with friends and you have to split the bill, offer to charge the meal to your card and ask them to pay you instead. If you own a small business, use your card to make purchases. You’ll be surprised to find out you get to fly long-haul for free sooner than you think!

Before you think about perks, however, keep this in mind: never spend more than you can pay in full each month. It is bad practice to pile up debt. You’ll also have trouble securing a loan in the future if you habitually pay just the minimum amount required, or worse, you never pay on time. This is because each card holder’s credit history is permanently stored by a regulating body, and you don’t want to have a negative record.

Lastly, always negotiate with your bank manager to waive your annual fees. If you build a good relationship with the bank by using your card often and paying your bills on time, they would happily grant you this privilege.

Speaking of Credit, When Should You Get a Loan?

The only time you should secure a loan is when you're purchasing an asset—something that you will use to earn more money. It can be a business investment, a piece of equipment to support your side hustle or a piece of real estate for rental income. Whatever it is, it must come with a sound financial forecast, which ensures your earnings can pay for the loan.

If it is not an asset, consider other ways of financing it or commit to paying below 30% of what you’re earning each month.

How Much Money Should You Keep for Emergencies?

The current crisis has put us out of ease. Suffice to say, no matter how much we plan for our future, we will never be ready enough for the worst. It is prudent, however, to be prepared.

A key part of your savings strategy should be to keep (and not touch) at least six months’ worth of income in an emergency fund so that when problems arise, you won’t be forced to borrow money or sell your investments at a loss.

RELATED: How To Prepare For The Looming Economic Disruption

Beware of Online Shopping Traps

Shopping used to only be a temptation in retail spaces, but today, our favorite brands follow us around the internet, making it harder for us to resist spending impulsively. Temper these spending traps by hiding ads and turning off notifications. One way to also manage your spending is to top-up the same amount every month and only spend within that budget. Our future selves will thank us.

A few wise ways to spend online would spend with reward programs like Shopback, which facilitates rebates for every purchase.

Separate Your Accounts Strategically

This helps you deliberately store and use cash for their intended purposes.

For example, use Account 1 for your monthly salary, which will also be used for essential expenses. Account 2 is where you place freelance earnings, which will be placed in investments. Account 3 is for business sales and expenses, which must not be mixed up with personal finances.

Like A Business, Close Your Books

At the end of every month, businesses record and review their income and expenses for two reasons: for tax purposes and for making better decisions. This applies to individuals, too.

Use a money management app or an Excel template to record your income and expenses. Whether you do it daily, once a week or at the end of every month, be consistent. Know how much you spend per month on average. Then, adjust your budget and habits—spending less or earning more—to inch closer to your goal.

Lastly, But Most Importantly, Revisit Your Why

Determine your internal compass. Assess: What are non-negotiables? What are nice-to-haves? Then manage cash in a way that supports your mission, goals and values.

Hannah To enjoys writing about travel, entrepreneurship, productivity and self-development. This is her third article in a series about financial freedom on Wonder.

She shares her thoughts on Instagram and Medium.

Words Hannah To

Art Matthew Ian Fetalver